Summary: Trader Joe is a versatile DeFi platform offering services like token swapping, yield farming, and lending. What sets it apart is its Liquidity Book, an innovative Automated Market Maker designed to boost capital efficiency for liquidity providers. The platform is built on multiple blockchains and has robust Total Value Locked (TVL) figures. Trader Joe also features a unique NFT marketplace called Joepegs. With transparent tokenomics and credible founders, it aims to be a reliable and user-focused solution in the DeFi space.

What is Trader Joe?

Trader Joe is a multifaceted DeFi platform that offers a range of services, including token swapping, yield farming, and lending. What sets it apart is its proprietary Liquidity Book, which is a highly efficient Automated Market Maker (AMM) designed to maximize capital utility for liquidity providers. With features like zero slippage trading and surge pricing during high volatility, Trader Joe aims to be a comprehensive solution for decentralized finance needs.

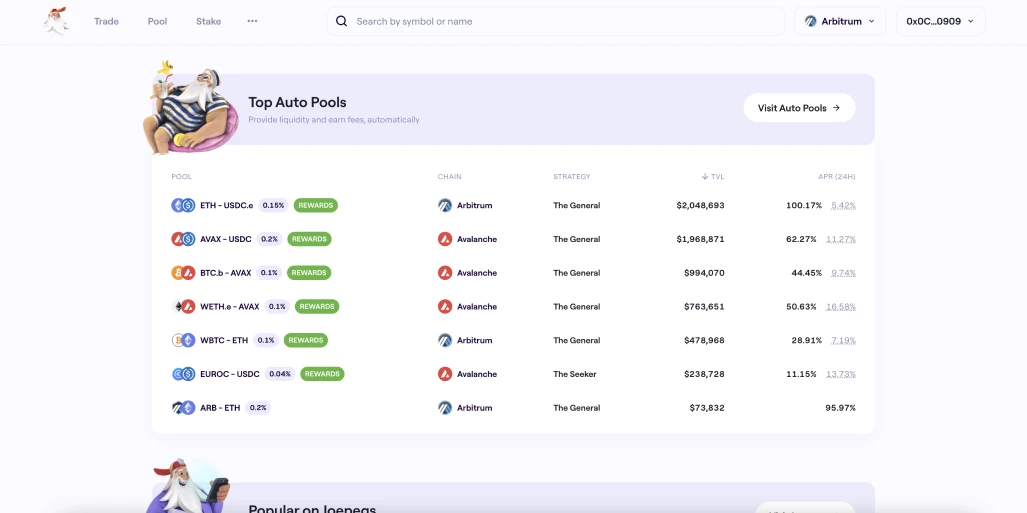

Built on networks such as Avalanche, Arbitrum, and BNB Chain, Trader Joe has further distinguished itself through its unique approach to concentrated liquidity. Unlike traditional AMMs, Liquidity Book allows liquidity providers to set specific price ranges, optimizing the platform for high trading volume with minimal liquidity requirements. This focus on capital efficiency and user-centric features makes Trader Joe a noteworthy platform in the crowded DeFi space.

What is the Liquidity Book on Trader Joe?

Liquidity Book is an innovative feature on the Trader Joe platform that reimagines how Automated Market Makers (AMMs) can operate. Designed to offer an optimized experience for both traders and liquidity providers, it introduces unique mechanisms to enhance capital efficiency and profitability. Here is a high-level overview on how liquidity book works:

- Zero Slippage: Allows traders to swap tokens without losing value due to price changes within specific trading ranges or "bins."

- Concentrated Liquidity: Lets liquidity providers choose specific price ranges to supply liquidity, making their capital more efficient.

- Surge Pricing: Liquidity providers can earn additional dynamic fees when the market experiences high volatility, optimizing their returns.

- High Capital Efficiency: Designed to support high trading volumes with relatively low liquidity requirements, making it more profitable for liquidity providers.

- Flexible Liquidity: Liquidity providers can customize how their liquidity is distributed, tailoring it to suit their individual strategies.

- Unique Bin System: The system uses discrete "bins" for trading ranges, rather than continuous price "ticks," setting it apart from AMMs like Uniswap V3.

- Fixed + Variable Pricing: The AMM has a pricing model that includes both fixed and variable components, allowing it to adjust fees based on market conditions.

What is Joepegs?

Joepegs Marketplace is a dynamic platform aimed at enriching the digital collectible ecosystem for both creators and collectors. Built to operate on Avalanche and BNB blockchains, the marketplace goes beyond mere listing and trading functionalities by introducing a robust set of features. Key elements like LaunchPEG, an NFT launchpad, offer multiple auction styles and minting options, including flat mints at a fixed price. For a more customized launch experience, collections can use whitelist wallet addresses to grant special perks to valued community members.

Supported Networks

Trader Joe boasts a solid Total Value Locked (TVL) across various blockchains. The platform shines particularly bright on the Avalanche network with a TVL of $49 million. It's also gaining traction on Arbitrum, featuring a TVL of $27 million there. Although its presence is more modest on Ethereum's mainnet and BNB Chain with TVLs of $1.5 million and $1.3 million respectively, it's important to remember that every blockchain brings its unique audience and advantages.

Trader Joe Tokenomics

Trader Joe's tokenomics revolves around its native JOE token, designed to serve as a governance mechanism and a rewards system. With a fixed supply and a decaying emission model, the token sees 850 daily emissions mainly directed towards yield farming. A slice of the platform's revenue, specifically 0.05% of all trades, also goes into the sJOE staking pool.

When it comes to token distribution, it's both balanced and transparent. Liquidity providers get 50% of the tokens, the treasury takes 20%, the development team receives another 20%, and 10% is reserved for future investors. There are no pre-sales or private sales, making the platform truly decentralized. This structure encourages active participation from both developers and users, ensuring Trader Joe's growth and stability.

Trader Joe Crypto Founders

Established in 2021, Trader Joe was founded by two semi-anonymous figures, 0xMurloc and Cryptofish. Their mission was to build a groundbreaking trading platform on the Avalanche blockchain to push the boundaries of decentralized finance. Cryptofish states he's an experienced full-stack and smart contract engineer, having contributed to Avalanche-centric projects like Snowball and Sherpa Cash.

He also notes a past role at Google and a Master's in Computer Science. 0xMurloc describes himself as a full-stack developer with startup exposure and a Senior Product Lead position at Grab. Given their anonymity, these details are based on their own declarations.

Final Thoughts

In summary, Trader Joe emerges as a user-centric, highly efficient DeFi platform that offers a unique approach to decentralized finance through its Liquidity Book feature. Built on multiple networks and boasting solid Total Value Locked figures, it promises optimized capital use for liquidity providers and superior trading experiences for users. The platform's transparent tokenomics and semi-anonymous yet credible founders further reinforce its reputation as a reliable and innovative solution in the crowded DeFi landscape.

.png)

.webp)