Summary: Aura Finance is a protocol that is built on top of the Balancer Ecosystem that provides boosted incentives to Balancer liquidity providers. The platform allows users to stake Balancer LP tokens on Aura Finance to earn rewards in the form of AURA tokens. The rewards are generated through a series of smart contracts that redistribute fees from Balancer trades.

The dynamic of Aura Finance and Balancer is similar to how Convex and Curve Finance interact, with AURA being the parallel to Convex. The advantage of Aura over Convex is their speed to deploy cross-chain and ability to attract liquidity and high yields on different networks.

What is Aura Finance?

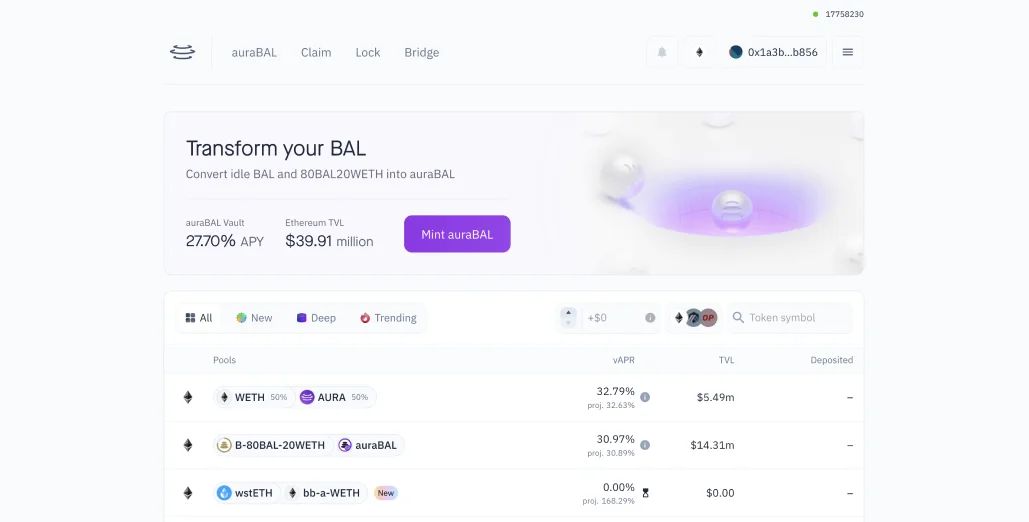

Aura Finance is a protocol built on the Balancer system, designed to optimized incentives for Balancer liquidity providers and BAL stakers. It creates a tokenized wrapper token called auraBAL for BAL stakers, which can be staked to receive rewards from Balancer, a share of any BAL earned by Aura, and additional AURA tokens. The minting process is irreversible, but auraBAL can be traded back to BAL through an incentivized liquidity pool.

For liquidity providers, Aura simplifies depositing into the Balancer gauge system, allowing depositors to achieve a high boost through the protocol-owned veBAL and accumulate additional AURA rewards. The AURA token serves as a governance tool within the ecosystem, granting governance rights to holders of locked AURA tokens and enabling them to vote on internal proposals.

How Does Aura Finance Work?

Aura Finance works by redistributing fees derived from Balancer trades. When a user provides liquidity to a pool on Balancer, they receive BAL tokens in return as compensation. This BAL is then used to cover the costs of trading and any fees are distributed to Aura holders.

The AURA tokens are then used as rewards for liquidity providers. When a user deposits their Balancer LP tokens to the Aura platform, they will receive AURA tokens in return which can be redeemed for more BAL or other assets. Overall, the dynamic between Balancer and Aura creates a positive loop of incentives where liquidity providers can earn both BAL and AURA tokens for their efforts.

What Assets can I Deposit on Aura Finance?

Users of Aura Finance can only deposit Balancer LP tokens to take advantage of the boosted incentives. LP tokens are minted when a user provides liquidity to a pool of assets on Balancer, and they represent their stake in that pool.

Some of the most popular LPs on Aura and Balancer are the wstETH/WETH Pool at $175m TVL and the rETH/WETH Pool at $36m TVL.

Protocol Fee Structure

Aura Finance charges a flat fee of 25% of total revenue generated from Balancer LPs. The fee is then distributed to different network stakeholders as follows:

- 20.5% goes to auraBALstakers. This is paid out as BAL.

- 4% goes to AURA lockers. This is paid out as auraBAL.

- 0.5% goes to the harvest caller. This is paid out as BAL.

Aura Finance Token Emissions

he Aura Protocol token emission and distribution was initially planned with 50% for Balancer LP rewards, 10% for StableSwap, 2% for bootstrapping liquidity, 3% for an AURA/ETH LP, 17.5% for the Treasury vested over 4 years, 2.5% for bootstrapping token holder base, 1% for future incentives, 2% for BAL treasury, 2% for veBAL bootstrapping incentives, and 10% for Aura contributors over 2 years.

However, some changes were made to the pre-launch schedule, resulting in an additional 2.82 million AURA being added to the community Treasury, bringing the total supply to 2.82%. The token distribution was fair launched without any VC or seed investors.

Is Aura Finance Safe?

Aura Finance has been thoroughly audited by multiple security firms and is considered to be secure and trustworthy. The platform also relies on the same core technology as Balancer which adds to its security. In addition, Aura’s smart contracts are open-source and can be viewed in their GitHub repository for full transparency.

Final Thoughts

To conclude, Aura Finance, built on Balancer, offers optimized incentives for Balancer liquidity providers and BAL stakers through auraBAL and AURA tokens. This protocol simplifies the deposit process into Balancer's gauge system, facilitating a positive incentive loop for liquidity providers. The 25% fee on Balancer LPs' total revenue is fairly distributed among stakeholders, further promoting participation. Aura Finance assures security via thorough audits and open-source smart contracts, allowing only Balancer LP tokens for deposits, making it a promising tool for liquidity providers.

.svg)