Summary: A decentralized exchange, often referred to as a DEX, is an innovative platform that facilitates direct peer-to-peer cryptocurrency transactions between participants without the need for an intermediary or central authority. Operating on blockchain technology, they ensure transactions are transparent, secure, and immutable. Unlike traditional centralized exchanges, where a single entity controls the trading environment, DEXs empower users with full control over their funds and personal data by utilizing smart contracts.

To assist you in your crypto journey, we've compiled a list of the top 5 DEXs across multiple blockchain networks, each distinguished in its unique way:

- Uniswap - Best Overall Decentralized Exchange

- GMX - Best Decentralized Derivatives Platform

- Curve Finance - Best DEX for Stablecoins

- DefiLlama DEX - Best DEX Aggregator

- Osmosis - Best DEX for Cosmos Ecosystem

Best Decentralized Exchanges

Our distinct methodology critically evaluates and categorizes the best decentralized exchanges in the crypto market. This process inspects various aspects for each exchange, such as their adherence to DeFi principles, transaction fees, support options, simplicity of interface, liquidity provision, smart contract reliability, and additional key features.

1. Uniswap

Uniswap reigns supreme as the most influential decentralized exchange (DEX) platform globally, standing out with its unrivaled trading volume and expansive user base. Operating on multiple EVM-compatible chains such as Ethereum, Polygon, Arbitrum, Optimism, and Celo, Uniswap opens the door to seamless trading of an extensive range of ERC-20 tokens. It does this while maintaining affordable transaction fees and robust liquidity.

It is one of the rare DEX platforms with an embedded NFT Marketplace aggregator. This allows users to conveniently purchase, sell, and exchange NFTs, sourcing from popular platforms like OpenSea and beyond. The innovative Uniswap V3 introduces the concept of concentrated liquidity, which offers users more control over their liquidity provision. Additional offerings such as liquidity pools and flash swaps further strengthen Uniswap's claim as the leading, most comprehensive DEX in the market.

2. GMX

GMX is a reliable decentralized exchange (DEX) futures trading platform, ranking second globally. It empowers users with the opportunity to trade a range of crypto derivatives, such as perpetual contracts and futures, amplifying their trading prowess with high leverage up to a staggering 50x.

Holding the title as the most voluminous futures DEX, GMX facilitates hundreds of millions in trades across a broad selection of 30 different tokens every single day. GMX's presence extends across Arbitrum and Avalanche, and plans are underway for its imminent expansion to the BNB Chain. Key features of GMX that distinguish it include the GMX Earn program, enabling users to stake GMX and receive protocol fees, thus providing a rewarding mechanism for participation.

3. Curve Finance

Claiming the global third spot among DEX platforms is Curve Finance, a specialist in ERC-20 and USD stablecoin pairings. Specifically designed for high volume traders, Curve minimizes slippage with its aggregate trading approach and uniquely offers low-friction stablecoin pairs like DAI/USDC and USDC/USD.

Curve operates across various chains such as Ethereum, Polygon, Binance Smart Chain, and Matic Network, showcasing its wide network. It also offers flash loans, staking capabilities, and has partnered with Convex Finance to enhance its services. Curve's governance system, CurveDAO, and its secure cold wallet storage solution, Curve Vault, consolidate its standing as the global third-best DEX.

4. LlamaSwap

As the fourth-best in the global DEX arena, LlamaSwap is a decentralized exchange aggregator offering users a simplified trading experience across multiple DEX platforms. With a unified interface, users can effortlessly tap into liquidity from prominent exchanges like Uniswap, Sushiswap, and Kyber Network.

What sets LlamaSwap apart are its unique features such as an automated portfolio builder, an NFT marketplace aggregator, and comprehensive on-chain analytics, adding a dimension of versatility to the platform. Available on Ethereum, Polygon, Binance Smart Chain, and other networks, LlamaSwap's extensive reach cements its position as a global top-tier DEX platform.

5. Osmosis

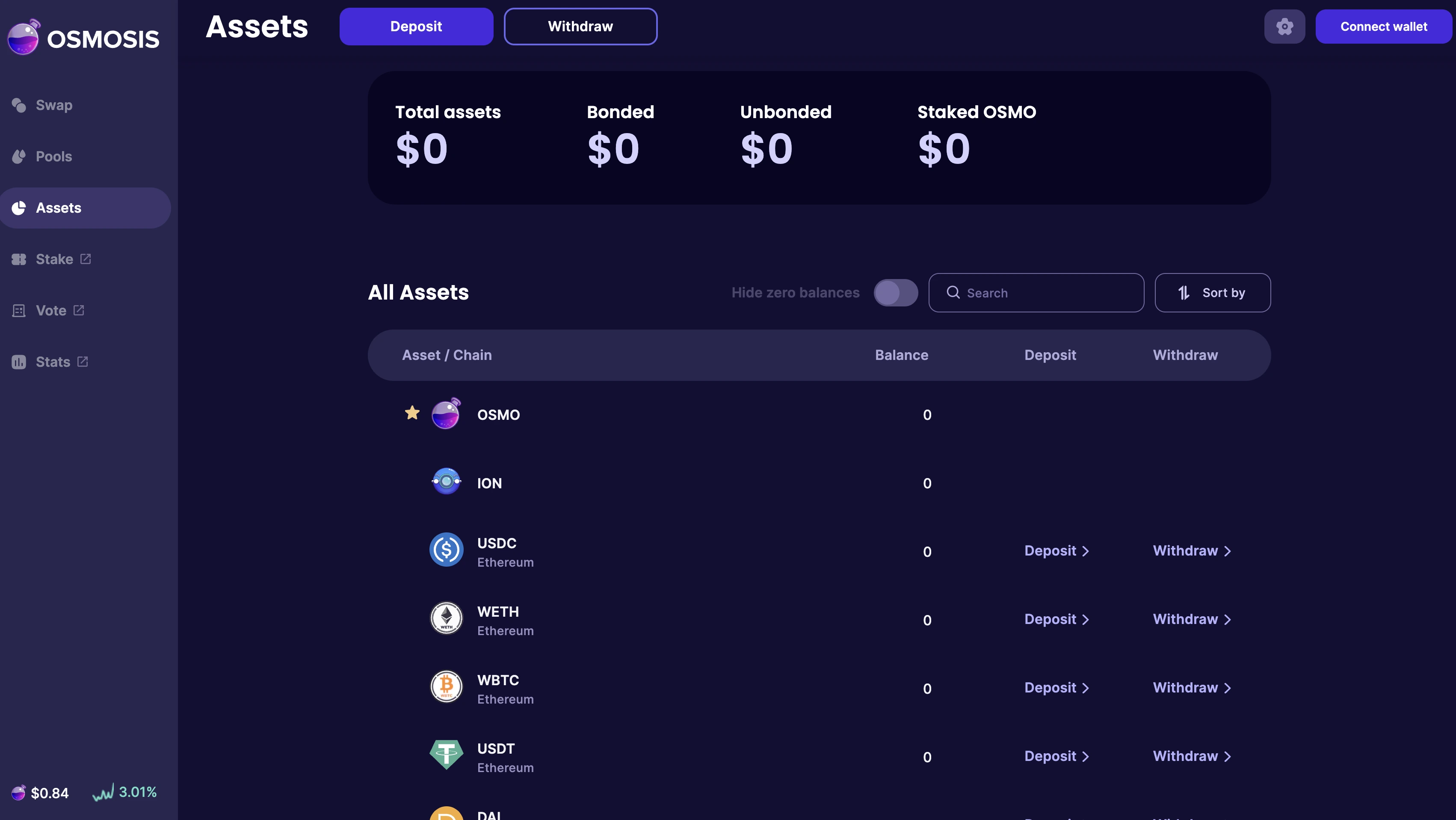

Rounding out the top five in the global DEX standings is Osmosis, a platform tailored specifically for the Cosmos ecosystem. Osmosis offers its users access to deep liquidity pools and low fees, in addition to advanced trading functionalities such as margin trading and derivatives.

The Osmosis DEX extends its presence across multiple networks, including the Cosmos Hub, Kava Mainnet, Terra, and Binance Smart Chain. Distinguishing features like the Osmosis Cross-Chain AMM, staking rewards, and a potent DEX aggregator for cross-chain liquidity further underscore its value proposition. These combined elements solidify Osmosis's position as the fifth-best DEX platform on a global scale.

What is a Decentralized Exchange (DEX)?

A decentralized exchange, or DEX, is an innovative cryptocurrency exchange rooted in a distributed, blockchain-based network. Its decentralization allows direct peer-to-peer trading of cryptocurrencies, bypassing the need for a centralized authority. Furthermore, DEXs utilize smart contracts, which are self-executing and facilitate trades by automatically matching buyers and sellers.

This framework heightens security, as DEXs are more resilient to threats like hacking due to their distributed data structure. Simultaneously, their autonomous operation leads to lighter regulation, offering traders potentially greater anonymity and freedom, thereby contributing to a more inclusive cryptocurrency trading environment.

What is the Cheapest DEX?

DefiLlama's Meta DEX Aggregator LlamaSwap is one of the most affordable DEXs on the market. It works as a comprehensive aggregation platform, incorporating renowned DEX aggregators such as Matcha and 1inch, to present users with an optimized path for token transfers across any blockchain. This strategic operation allows for minimum fees and speedy execution times, maximizing the efficiency of cryptocurrency transactions.

Final Thoughts

In conclusion, Decentralized Exchanges (DEXs) like Uniswap, GMX, Curve Finance, DefiLlama, and Osmosis are revolutionizing the crypto trading landscape, offering enhanced security, reduced vulnerability to hacking, and superior user control. Each DEX has its unique strengths, spanning across diverse blockchain networks and offering specialized services ranging from stablecoin trading to futures trading and DEX aggregation.

However, while DEXs provide greater security and freedom, they are not without risks, and users should always exercise caution and employ the necessary safeguards. As the crypto market evolves, these platforms continue to offer an exciting alternative to traditional exchanges, combining technological innovation with financial liberation.