Summary: Arbitrum has rapidly emerged as a leading Layer 2 protocol on Ethereum, offering faster and cheaper transactions compared to the Ethereum mainnet. With a growing DeFi ecosystem and a rapidly expanding user base, Arbitrum has attracted a range of innovative projects that are providing exciting new opportunities for investors and traders.

In this blog post, our research team has analysed the entire ecosystem and highlighted the top five projects on Arbitrum that are making a significant impact in the DeFi space. From cutting-edge decentralized exchanges to yield farming platforms, these projects are leading the way in providing users with new and exciting ways to engage with the Arbitrum network:

- GMX (GMX) - Best Overall Project on Arbitrum

- ZyberSwap (ZYB) - Fastest Growing DEX on Arbitrum

- Radiant (RDNT) - Best Money-Market on Arbitrum

- Gains Network (GNS) - Best Trad-Fi Derivatives Platform

- SolidLizard (SLIZ) - Best Alternative Arbitrum DEX

Top Crypto Projects on Arbitrum

We've been digging into the most popular cryptocurrency projects on Arbitrum, reviewing out over 15 unique protocols that are up and running on this Layer 2 solution. We've looked at key factors like how secure they are, how decentralized, the variety of uses they can have, how user-friendly they are, how well they can scale, and a whole lot more. After an extensive analysis, we've pulled together a list of the top five projects on Arbitrum that are really making waves in the world of layer 2 applications.

1. GMX (GMX)

Redefining decentralized exchanges, GMX stands out as the preeminent project on the Arbitrum blockchain. This platform enables users to directly trade popular cryptocurrencies from their digital wallets, offering spot swaps and up to 50x leverage on perpetual futures trades. GMX ensures users retain custody of their assets, unlike traditional centralized exchanges. Its unique multi-asset pool, GLP, provides lucrative rewards to liquidity providers and leverages Chainlink Oracles for dynamic pricing.

Launched on the Arbitrum One blockchain in September 2021 and expanded to Avalanche in January 2022, GMX quickly surged to become the second-largest derivatives platform in DeFi. This esteemed status is demonstrated by over $100 billion in trading volume, $140 million in daily open interest, and a vibrant community exceeding 230,000 daily users. Undoubtedly, GMX is the paramount project on Arbitrum.

2. ZyberSwap (ZYB)

ZyberSwap is a decentralized exchange (DEX) built on the Arbitrum blockchain, offering an automated market-maker (AMM) and low fees for swapping crypto assets. It boasts some of the most lucrative rewards for staking and yield farming on the entire Arbitrum network, making it an attractive option for DeFi users. The platform is fully committed to decentralization and community involvement, with all major changes decided via governance voting.

ZyberSwap has also chosen to employ a fair launch strategy for its token distribution, ensuring that all users have an equal opportunity to acquire its tokens. Further, the platform has undergone a thorough security audit and is incubated by Solidproof, which not only provides access to their expertise but also offers free audit and KYC processes for new projects. Overall, ZyberSwap is a secure and user-friendly DEX that is leading the way in the burgeoning Arbitrum ecosystem.

3. Radiant (RDNT)

Radiant is a cross-chain DeFi platform and is the first omnichain money market, allowing users to deposit any major asset on any major chain and borrow supported assets across multiple chains. The protocol's mission is to consolidate the fragmented liquidity that is currently spread across the top Layer 1 and Layer 2 protocols like Ethereum, Avalanche, Arbiturm, Optimism and other networks. Lenders who provide liquidity can earn value through the native token $RDNT. Borrowers can withdraw against collateralized funds to obtain liquidity without selling their assets.

Radiant launched v1 on Arbitrum, a secure and decentralized blockchain that allows the team to build an ecosystem with competitive interest-bearing opportunities while maintaining a high degree of safety. Radiant's cross-chain interoperability will be built atop Layer Zero, with v1 leveraging Stargate's stable router interface. Radiant's native utility token is $RDNT, with emissions allocated to users who provide utility to the platform as Lenders, Borrowers, and RDNT/WETH liquidity providers. The community votes on important measures using locked $RDNT.

4. Gains Netwrok (GNS)

Gains Network is one of the fastest growing decentralized trading platforms on Arbitrum that offers full custody of users' funds, median spot prices, and competitive fees. It allows trading of various assets, including crypto, forex, stocks, indices, and commodities, with high leverages of up to 150x on cryptos, 1000x on forex, 100x on stocks, 35x on indices, and 250x on commodities. Gains Network operates transparently and executes trades 100% on-chain. Its trading engine has no order books or liquidity for each pair, but a single gDAI vault for all trading pairs listed, making it 100x+ more capital efficient.

Synthetic leverage is used, and the DAI vault and the GNS token back the leverage. Gains Network utilizes a custom real-time Chainlink decentralized oracle network to get the median price for each trading order, effectively filtering out any outlier price action happening on a single exchange. The trading engine is fully decentralized, and users do not need to sign up or deposit to start trading. The platform is deployed on Arbitrum and has grown to over 100,000 users with $29 billion in volume traded since its inception.

5. SolidLizard (SLIZ)

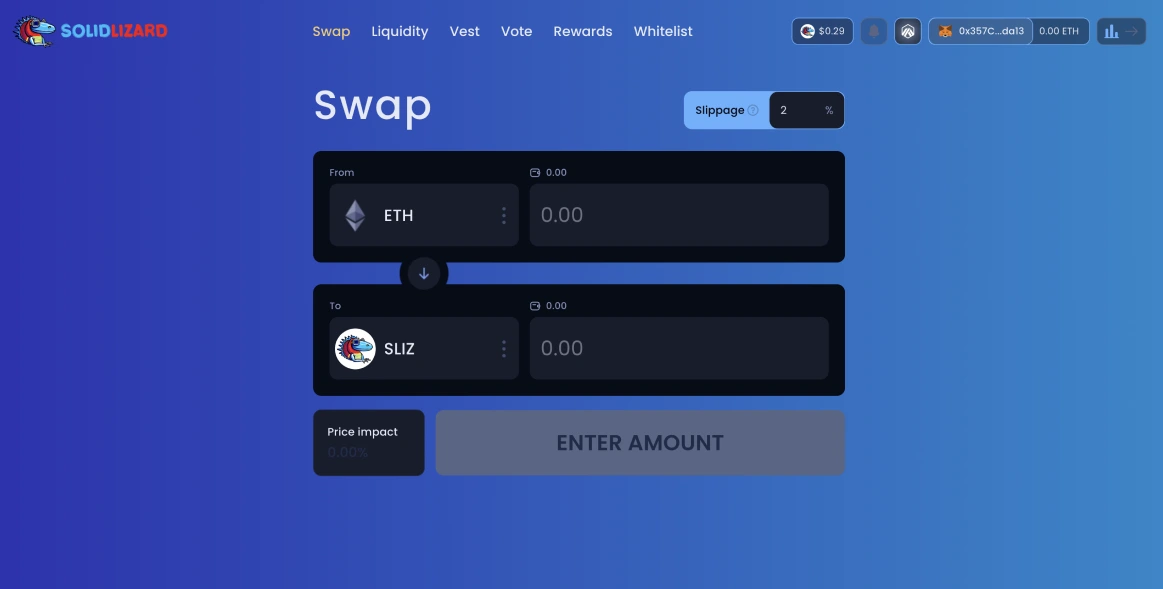

SolidLizard is a decentralized exchange deployed on Arbitrum, which offers low-cost token exchanges and reduced swap fees. It utilizes a governance model called the ve(3,3) system, which rewards active user participation through voting, bribes, and decisions on whether to lock or unlock the governance token. SolidLizard allows users to earn income through liquidity provisioning, receiving a share of the rewards allocated to incentivized gauges based on the amount of liquidity they have provided.

Approximately 62% of SLIZ's supply is directed towards liquidity providers, and 33% will go to veSLIZ holders at epoch 1. The veSLIZ holders will see their share of the emissions increase every week, rewarding long-term investors. The team receives 5% of the total emissions. Liquidity providers do not receive any swap fees from the gauge's trading volume. Instead, their income is generated from the rewards distributed by veSLIZ to the gauge.

Why is the Arbitrum Ecosystem a Promising Investment in 2023?

The Arbitrum ecosystem is growing rapidly due to its wider adoption and the scale-up of decentralized finance (DeFi) and gaming applications on the chain. According to a research report by Bernstein, the blockchain has the fastest-growing user base among leading blockchains, with daily transactions and revenue four times higher than six months ago.

The rapid transaction growth is also driven by the growing app ecosystem, with leading DeFi and gaming applications like GMX, Gains Network, and Radiant driving the growth. Additionally, new wallets and wallet activation trends are very strong, with new user acquisition doubling in the past six months and daily active users tripling over the same period. The report also notes that Arbitrum is the only chain where liquidity locked is growing.

Final Thoughts

In conclusion, the Arbitrum network is shaping up to be an influential force within the cryptocurrency and DeFi landscape, underpinned by its fast-growing user base and adoption by innovative projects. GMX, ZyberSwap, Radiant, Gains Network, and SolidLizard are currently leading the pack, each providing unique solutions that enhance the user experience on the Arbitrum platform. These projects, backed by their robust functionality and the commitment to decentralized finance, are charting the course of Arbitrum’s future.

As a Layer 2 solution, Arbitrum's rise in daily transactions and revenue, its expanding app ecosystem, and the increase in wallet activations collectively make it an enticing prospect for both current and potential investors. Indeed, the remarkable strides made by these projects make the Arbitrum ecosystem a promising investment in 2023.