Layer 2 (L2) rollups have become an integral part of the Ethereum ecosystem, leading its near- and mid-term scaling strategy since late 2020 (as ushered in by Vitalik in his forum post, and later blog).

Fortunately, by this time, both of the teams behind Arbitrum and Optimism were already hard at work, readying for the launch of their own rollups the following year. Fast-forward to today’s bear market and we can still see the continuation of L2 growth, even as some major alternative L1s decline.

Arbitrum vs Optimism

Although their base technology is shared, they have a number of fundamental differences.

In order to validate transactions, Arbitum uses multi-round proofs in an interactive verification game between the prover and sequencer, whereas Optimism previously used single-round fraud proofs executed on L1. This was until a flagged vulnerability led to the disabling of their proofs. Optimism still operates today without fraud proofs meaning users must trust the Sequencer node (run by Optimism PBC). This isn’t currently of too much concern due to the centralised nature of both L2s (one must also trust the Arbitrum Sequencer node).

Protocol Upgrades

Arbitrum released a major upgrade to its stack on 31st August 2022. Primarily, aligning the chain much closer with Ethereum through its integration of geth, as well as separating execution code from proving code to optimise for security and portability. This led to an increase in execution speeds in the range of 20-50x, cost reduction by a factor of 2 and an overall transaction throughput capacity increase of 7x (equivalent to 7 Ethereums).

Optimism, on the other hand, is still operating on a technology stack from November 2021. However, the next upgrade, Bedrock, should be released by the end of the year. Much like Nitro, Bedrock will optimise calldata submission to L1 and separate execution from other layers in an effort to create a modular stack. Following on from Bedrock will come Cannon, their next-generation fault proof system, aligning them closely with Arbitrum’s current solution.

Scalability and Transaction Fees

L2s were pioneered due to Ethereum’s slow speed of transaction and rising gas fees. Arbitrum, with their Nitro upgrade, have outmatched Optimism, for now. This is immediately visible looking at transaction fees from L2Fees, where Arbitrum boasts half the fees of Optimism for a Swap, and over a 4-fold decrease in an ETH transfer at the time of writing.

In terms of transactional capacity, both chains have theoretical maximums far above that at which they are currently operating (~200K tx/day) - as referenced by Arbitrum’s ability to now process above 7 Ethereums worth of capacity (7x ~1M tx/day).

Application Ecosystem

To the average user, the above technicalities would bear next to no weight on their L2 of choice. Rather, the application ecosystem and communities behind them are what drive user adoption.

DeFi and Ecosystem Adoption

As of writing, Arbitrum has a TVL of $982.5M (up 48% in 3 months), sitting just ahead of Optimism at $902.8M (up 273% in 3 months). This is quite the contrast to alternative L1s, where Avalanche, Solana, and Fantom have all had their TVL continue to bleed away over the last 3 months.

L2 vs. Alt-L1 TVL market share metrics for the past year (DefiLlama)

In terms of overall unique addresses, Optimism beats Arbitrum with 1.6M to 1.45M. However, diving into the stats we see that 456K of those Optimism addresses were created on the airdrop announcement day - likely to check their amount to claim, as many non-L2 users were airdropped.

Looking at a shorter timeframe, we can see higher activity in the Arbitrum ecosystem, with the following unique active addresses:

Arbitrum

- 1 Day = 33.7K

- 7 Day = 131K

- 30 Day = 376K

Optimism

- 1 Day = 21.5K

- 7 Day = 83.6K

- 30 Day = 249K

Finally, we can look at the number of protocols that decided to build on each L2, with Arbitrum again taking the crown at 110+ compared to Optimism’s 70+ (DefiLlama).

Both L2s share many DEXs, bridges and lending protocols. The leading platform on Arbitrum is GMX, a decentralised spot and perpetual exchange with an innovative zero-slippage liquidity pool. On Optimism, Aave (lending) and Synthetics (derivative liquidity) have the largest TVL on the chain, however, the leading native protocol is Velodrome, a liquidity layer and AMM (Solidly fork).

NFTs and GameFi

Both Arbitrum One and Optimism have produced fairly weak results in this area (especially GameFi) when compared to alt-L1s, most likely due to their inheritance of Ethereum’s other layers, keeping transaction costs above $0.01.

Looking at NFT marketplaces, Arbitrum has gained more attention as demonstrated by Opensea recently supporting the chain. Other marketplaces include Stratos, TofuNFT and Treasure. Treasure is a gaming and NFT ecosystem with a currency, MAGIC, backed by all the metaverses and communities within the ecosystem. Conversely, Optimism has struggled to coerce developers, even with an NFT and Gaming Committee - however, their granting of DAO funds through governance is still in its infancy.

Going head-to-head in terms of NFT activity, Arbitrum takes the win with 13M transfers and 6,377 ETH in total volume, compared to Optimism’s 2.8M transfers and 1,864 ETH volume, according to NFTscan. Additionally, Arbitrum can boast its own collective of native ‘blue chips’ in GMX Blueberry Club, Diamond Pepes, and Smol Brains.

In order to overcome some of these shortcomings, Arbitrum has recently launched Arbitrum Nova, a new rollup design with an external Data Availability Committee (DAC). This lowers fees even further, with some trade-offs in trust, allowing for social and gaming applications to be achieved. The first example of this is Reddit’s Community Points system (MOONS) migrating to Nova.

Tokenomics and Governance

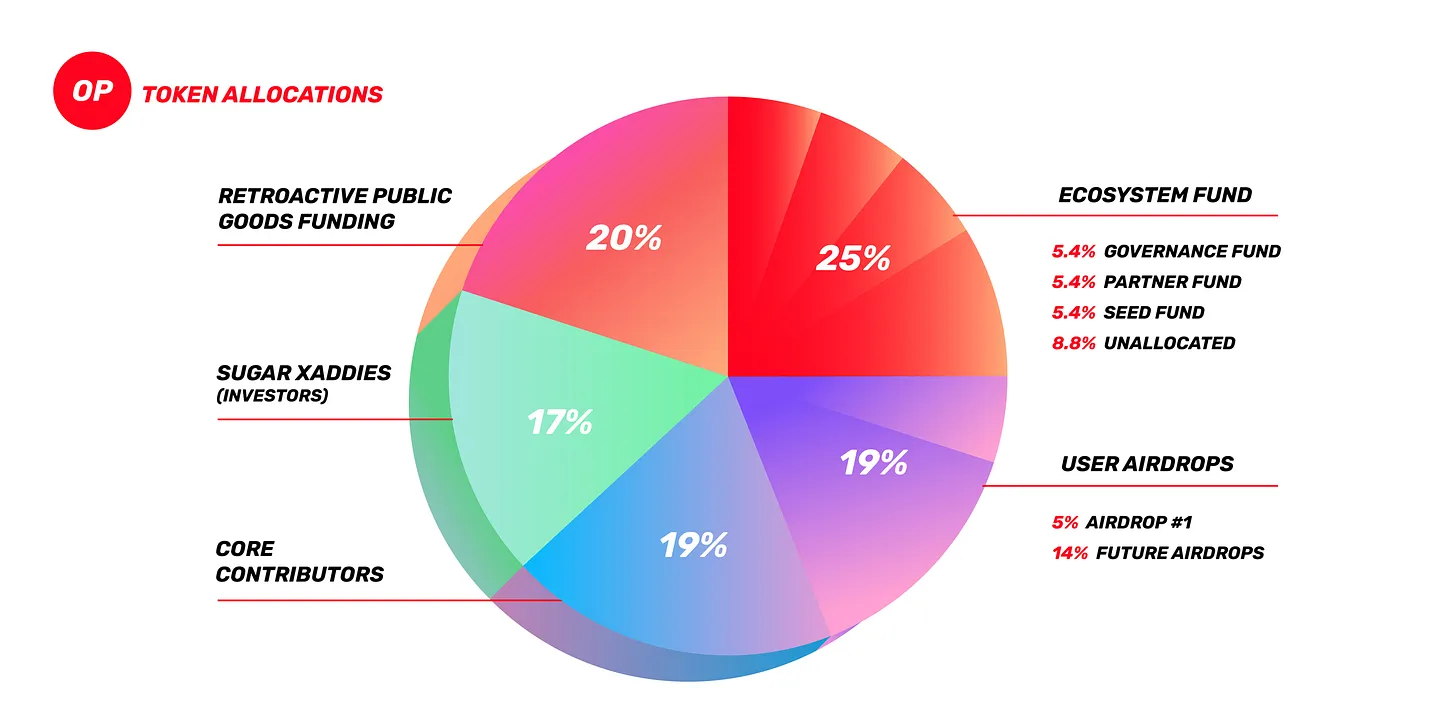

Tokenomics and governance is where Optimism definitely has the jump on Arbitrum. Earlier in the year, the Optimism Collective was launched, alongside the OP token. Through emissions of this native token, along with revenue from the protocol, capital is allocated to projects and communities building for the ‘common good’.

The Collective consists of two separate houses:

- Token House (OP holders) - votes on Governance fund grants, protocol upgrades, inflation adjustment and more

- Citizens’ House (Soulbound NFTs) - distributes retroactive public goods funding

- Note: there is no information on the date or criteria for Citizens House citizenship

In contrast, Arbitrum has offered barely any clues as to the governance of the protocol moving forward. However, now their technology has reached a point of maturity, expect the team to begin making strides in this direction.

What is extremely telling, however, is the adoption and user activity on Arbitrum One despite the lack of any incentives, which almost certainly can be attributed to the huge rise in Optimism’s activity and TVL over the past few months.

Final Thoughts

In conclusion, Arbitrum and Optimism are two prominent Layer 2 rollups in the Ethereum ecosystem, each with distinct philosophies and focuses. Arbitrum prioritizes technology and product-market fit, while Optimism emphasizes community involvement and decentralized governance. Despite their differences, both play a vital role in scaling Ethereum and fostering the growth of DeFi, NFTs, and GameFi. As the competition between these rollups continues, it is essential to monitor their advancements in technology, governance, and user adoption to determine their long-term impact on the crypto landscape.

.svg)