Summary: Independent Reserve and CoinSpot are cryptocurrency trading platforms that cater to the Australian market. Independent Reserve primarily serves investors in Australia, New Zealand, and Singapore, offering direct deposits in AUD, NZD, and SGD. CoinSpot is specifically designed for residents in Australia, focusing on simplicity and user-friendly features, allowing direct AUD deposits.

CoinSpot vs Independent Reserve Overview

Established in 2013, Independent Reserve is available in Australia, Singapore, and New Zealand, and has amassed a loyal customer base of over 250,000 registered customers. The platform is notable for features like 2x leverage trading, dollar-cost averaging (DCA) investing strategies, an Over-the-Counter desk, and a mobile application.

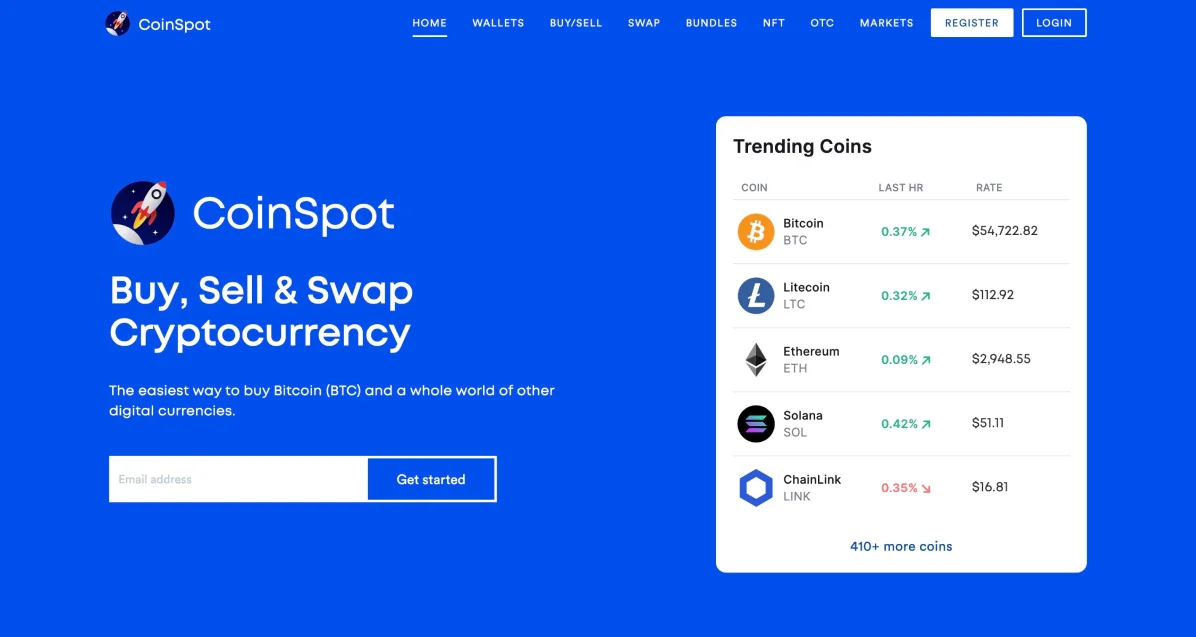

CoinSpot was also founded in 2013 and has become a prominent name tailored to the Australian crypto community. Known for its user-friendly design with both desktop and mobile compatibility, it has excelled in making digital currencies accessible for everyday Australians. It is considered Australia’s most secure and trustworthy platform for buying digital assets and NFTs.

Products and Services

Independent Reserve offers a curated selection of 50 cryptocurrencies and allows up to 2x leverage, aligning well with the trading preferences of the Australian and New Zealand markets. The platform boasts its Airbridge API, which is tailored for high-frequency trading. A distinct feature is its "DCA-investing" option, simplifying dollar-cost averaging for traders. It also provides an SMSF service for those looking to incorporate cryptos into their retirement portfolios.

CoinSpot lists over 420 cryptocurrencies and focuses on making trading as straightforward as possible. While it doesn't offer leverage, it excels in features like "Instant Buy/Sell", which enables quick and hassle-free transactions. CoinSpot also brings to the table an NFT marketplace, a crypto wallet and debit card, staking services, Bundles (Crypto ETFs) and a mobile app.

Winner: CoinSpot provides a feature-rich platform, a more extensive cryptocurrency list, and services geared towards everyday users.

Supported Countries

Independent Reserve specifically caters to the Australian, New Zealand, and Singaporean markets, limiting its services to residents of these areas. The platform has been meticulously designed to adhere to these countries' local regulations and standards, ensuring full legal compliance.

CoinSpot, on the other hand, focuses primarily on the Australian market, serving only Australian residents. While it may not have the international reach of other platforms, its services are fine-tuned to meet the regulatory requirements of Australia, making it a strong local choice.

Winner: Independent Reserve has a broader reach by extending its services to New Zealand and Singapore so it holds a slight advantage due to its multi-country focus.

AUD Payment Methods

Independent Reserve is keenly attuned to its core Australian audience, offering a range of payment options in AUD. This includes transactions through credit and debit cards, along with the widely used local method of Electronic Funds Transfer (EFT). To make transactions even more convenient, they also support the Osko and PayID systems for rapid bank transfers.

CoinSpot also excels in offering diverse AUD payment options. The platform enables credit and debit card payments, POLi Payments, BPAY, PayID, bank transfers and cash through BlueShyft, a nationwide news agency with thousands of locations.

Winner: CoinSpot is slightly better due to its support for instant bank transfers through Osko and PayID, plus cash payments.

CoinSpot vs Independent Reserve Fees

Independent Reserve operates on a tiered fee model where trading fees vary between 0.5% and 0.05%, contingent on a trader's 30-day trading volume. This design is set to incentivise more frequent trading, particularly for those active in larger volumes. Some deposits in AUD are free, with some others ranging around 3%. A modest fee is charged for cryptocurrency withdrawals.

CoinSpot has a straightforward fee system with a flat 1% trading fee for most transactions. It also allows traders to reduce fees to as low as 0.1% using the "Markets" feature, which requires a more hands-on approach to trading. Most of the deposit methods are free, and others range between 0.9% - 2.58%.

Winner: CoinSpot comes out on top with its tiered fee structure and multiple free AUD payment methods.

Security and Regulation

Independent Reserve is highly committed to security, adhering to Australia's strict regulatory framework. It is officially registered with both AUSTRAC and ASIC and holds membership in Blockchain Australia, enhancing its trustworthiness. The platform incorporates a host of security measures, such as two-factor authentication (2FA), cold storage solutions for digital assets, and routine security audits to ensure the integrity of its systems.

CoinSpot also places a premium on security but takes a slightly different approach. While it too is AUSTRAC registered, it focuses heavily on user-friendly security protocols. Features like 2FA are standard, and it also employs additional security layers, such as biometric identification and email confirmations for significant account actions. However, unlike Independent Reserve, it does not publicly disclose undergoing regular external audits.

Winner: Independent Reserve edges out with its comprehensive, regulation-aligned security features, offering an extra layer of confidence for Australian traders.

Final Thoughts

To conclude, both Independent Reserve and CoinSpot are both popular options in the Australian cryptocurrency trading landscape, each with its own set of advantages. Independent Reserve offers a more international scope by catering to traders in New Zealand and Singapore as well. It stands strong with sophisticated features like 2x leverage trading and dollar-cost averaging strategies.

CoinSpot, however, is more attuned to the everyday Australian user, offering a simpler, feature-rich platform that includes a wide range of cryptocurrencies and convenient AUD payment options. Its simple design and straightforward fee structure make it ideal for those who prioritise ease of use and variety in trading options. It also offers significantly more features and services.